|

Algorand DeFi

The Algorand DeFi ecosystem is sustained and bolstered by the three DeFi Pillars of Algorand. Fundamentally, it's about assuring the sustainable growth of the ecosystem in the long-term, which is why the Algorand Foundation have invested heavily in supporting the main actors of each 'pillar'. In this article we cover the 3 most important DeFi projects on Algorand.

The 3 Algorand DeFi Pillars are defined by the the Algorand Foundations in Aeneas Program, which goal is to set the base for a flourishing Algorand DeFi ecosystem. The pillars and their main contributors are the following:

- Robust Bridges for Newcomers - Algomint

- Automated Market Maker DEXs for Traders & Merchants - Tinyman

- Borrowing & Lending Platform for Capital & Commerce - Folks Finance

💡Pro Tip 💡

You'll need to have an Algorand Wallet installed on your phone in order to engage with the Algorand DeFi ecosystem (including Tinyman, Folks Finance and Algomint). Check out the AlgoDaddy Pera Algo Wallet Guide to read more about it and learn how to set it up.

|

Website - Algomint

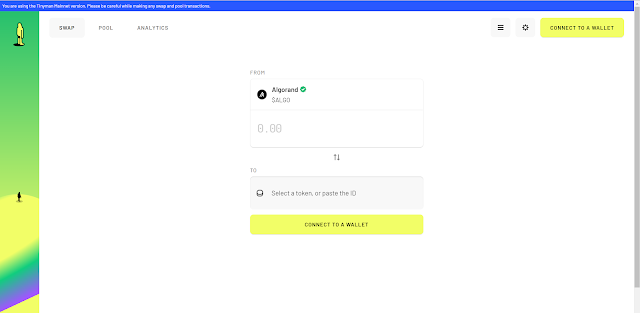

2. Tinyman

Tinyman is the first decentralized exchange (DEX) created for ASA tokens on Algorand. It launched on 7th of October 2021. They've excelled at what they do and delivered an all around great application (apart from a bit of a hiccup in beginning). The Tinyman launch definitely lead to a more accessible ecosystem and a more engaged Algorand community overall. You could even go as far as to say that prior to Tinyman, the Algorand DeFi was basically nothing.Hence it's without a doubt that Tinyman is one of the most important tools in the Algorands ecosystem. It allows liquidity pools to be formed between Algorand and different ASAs, or even between the ASAs themselves. As a result you don't really need a token to be listed on an exchange in order to trade it.

Additionally, users and developers can set up their own liquidity pools for token pairs previously not existing. Not only that, but all of this is provided by Algorands underlying secure, cheap and fast protocol. Due to this, those using the Algorand blockchain were now able to freely trade the popular Algorand tokens (HDL, DEFLY, USDC and others) as well as bolstering the creations of community tokens, some which rose in popularity very quickly (for example the Akita Inu Token). Participating in liquidity can earn you rewards and especially so if the pool in question is connected to the Algorand Governance DeFi Program.

As far as DEX's go, there are now plentiful of options to chose from apart from Tinyman, such as Pact Finance and Humble DeFi.

Tinyman is the first decentralized exchange (DEX) created for ASA tokens on Algorand. It launched on 7th of October 2021. They've excelled at what they do and delivered an all around great application (apart from a bit of a hiccup in beginning). The Tinyman launch definitely lead to a more accessible ecosystem and a more engaged Algorand community overall. You could even go as far as to say that prior to Tinyman, the Algorand DeFi was basically nothing.

|

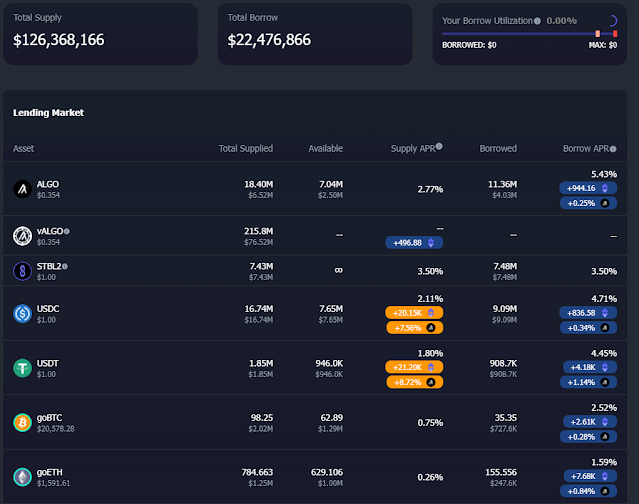

Website - Folks Finance

After shutdown of AlgoFi, Folks Finance has taken the throne as claimed the throne as the most important lending service on Algorand protocol. It have had a similar impact to what Tinyman have had on the Algorand ecosystem, but of course in it's own unique way. Lending is especially important for the Algorand ecosystem, as it allows leveraging of investment and accessibility of funds to key-players and everyday users alike. Thus you can potentiate your investments, or contribute to the TVL by lending your Algorand on Folks Finance.

Folks Finance launched in April of 2022, providing a cutting-edge non-custodial DeFi platform, empowering users with a comprehensive suite of tools to manage digital assets securely on the Algorand blockchain. As a non-custodial platform, users retain complete control over their funds by having access to the private keys associated with their ALGO or tokens. Before its launch, Folks Finance managed to amass an impressive $3 Million USD through seed funding. Recently, the platform unveiled V2.0, introducing a host of new features such as high efficiency loans, collateral swaps, multi-borrow, and flash loans, among others.

Folks Finance also allows you to participate in the Governance DeFi Program, resulting in extra rewards and the ability to keep participating in parts of the Algorand ecosystem by using gALGO.

💡 Algorand DeFi Utility💡

Learn more about the vast ecosystem of Algorand over in this article, where I have listed most of the available Algorand apps, networks, games and other utilities.